Protecting your business is crucial. With the right commercial insurance coverage, you can reduce your financial exposure. In Ontario, securing the perfect policy doesn't have to be a daunting task. Utilize our complimentary online tool to contrast quotes from leading insurance providers in just minutes.

- Identify the most budget-friendly coverage options available to suit your specific needs.

- Safeguard your property from unexpected events, such as damage.

- Benefit from peace of mind knowing your business is secure.

Hesitate to speak with our insurance experts if you have any concerns. We're here to guide you every step of the way.

Oshawa Brokers Enhance Expertise to Fulfill Rising Ontario Business Insurance Demands

As the Provincial business landscape evolves, Oshawa Brokers are strategically expanding their knowledge in the field of business insurance. Recognizing the rising demand for comprehensive coverage options, Oshawa Brokers are focused to providing companies with personalized solutions that address their unique challenges. This commitment to client success is evidenced by the latest investment in specialized initiatives for their staff, ensuring they stay at the cutting-edge of industry trends and best practices.

copyright's Commercial Insurance Landscape: Navigating the Rough Waters

Ontario's enterprise insurance sector is currently facing a volatile period. Providers are experiencing increasing claims, driven by factors such as rising costs. This situation is putting stress on rates, making it difficult for organizations to acquire the coverage they require.

Surmounting this environment requires a proactive plan. Businesses should thoroughly evaluate their risks, shop around from various insurers, and partner an knowledgeable advisor to locate the optimal solution.

Compare Ontario Business Insurance Premiums and Uncover the Best Deal

Running a business in Ontario comes with its fair share of responsibilities, and ensuring you have adequate insurance coverage is paramount. With numerous insurance providers available, it can be overwhelming to determine the most affordable option for your specific needs. The good news is that by taking the time to contrast Ontario business insurance premiums, you can obtain significant savings without sacrificing crucial coverage.

To make this process more manageable, consider utilizing online comparison tools that allow you to submit your business details and receive quotes from multiple insurers side-by-side. This can give you a clear overview of the market landscape and help you identify potential cost differences. Don't hesitate to speak with different insurance brokers to understand coverage options, terms and conditions, and any other concerns you may have.

By conducting thorough research and diligently comparing Ontario business insurance premiums, you can maximize your chances of finding the best deal that provides comprehensive protection for your venture.

Unlocking Savings : Affordable Business Insurance Quotes in Ontario

Ontario firms are always on the lookout for ways to reduce costs. One area where many uncover significant savings is through business insurance. Obtaining affordable quotes can be a straightforward process if you are aware of the right strategies and resources.

First, evaluate quotes from various insurers. Don't just settle the first option you find. Take your time to explore different companies and assess their coverage options and pricing.

Then, evaluate your specific business needs. What type of insurance coverage do you really require? Skip buying unnecessary coverage that will only boost your premiums.

In conclusion, look for discounts and incentives. Many insurers provide discounts for things like risk management. By being proactive and taking the time to shop around, you can discover affordable business insurance quotes in Ontario that meet your needs.

Protecting Your Success: Essential Business Insurance for Ontario Companies

Running a thriving enterprise in Ontario is a rewarding journey, but it's crucial to safeguard your hard work and assets. A comprehensive business insurance policy acts as a Liability Insurance for Ontario Companies vital safety net against unforeseen circumstances that could cripple your operations.

From property damage to liability, the right coverage can help you bounce back financial losses and minimize disruptions to your operations. Consider these essential insurance types:

- Public Liability: Protects against demands arising from physical damage or harm to possessions caused by your work.

- Business Property Insurance: Provides coverage for your building, machinery, and stock against damage from fire, theft, vandalism.

- Product Liability Insurance: Safeguards you against demands related to issues with goods that result in loss.

Consulting with an experienced insurance agent can help you determine the specific coverage needs for your specific Ontario business. Don't leave your success to chance - secure the right insurance to ensure peace of mind and safeguard your valuable assets.

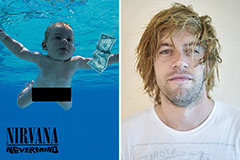

Spencer Elden Then & Now!

Spencer Elden Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

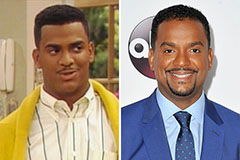

Alana "Honey Boo Boo" Thompson Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!